Two years ago, Mergers and Acquisitions magazine asked if it was “as good as it gets” for middle market transactions because of the following conditions:

- Historically low interest rates – Likely coming to an end in their opinion

- High credit (debt) availability to buyers to finance transactions high Credit market could tighten

- High public stock markets driving up private pricing – Had to be due for a correction

- The current up cycle in M&A had been going on for a while – Had to be due for a correction

- Private equity funds had been net sellers of their portfolio companies – The smart money was selling, so the market is peaking

The result was high multiples being paid in the private market. When would it end?

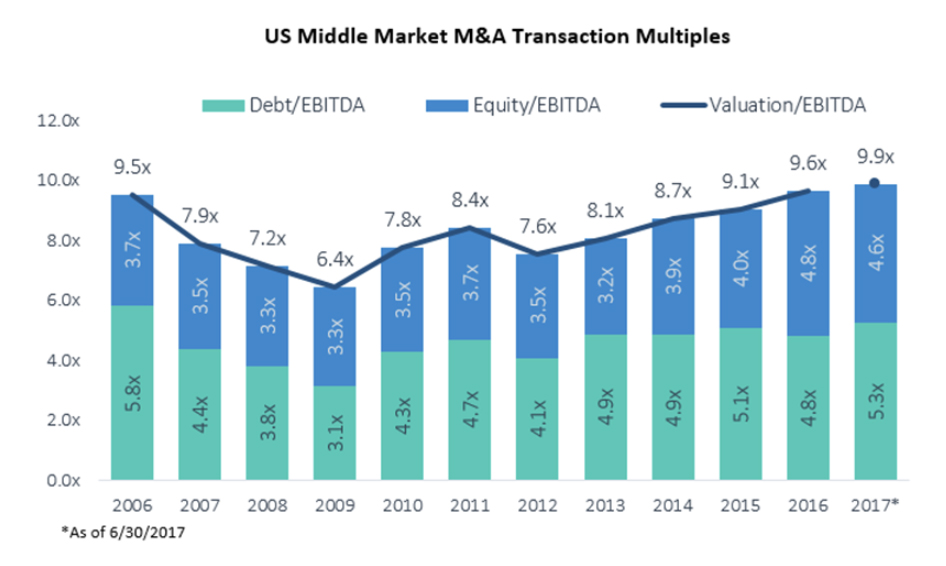

The middle market M&A market did not top out in the fall of 2015. True the number of transactions declined about 20% but, as a seller, all you care about is one transaction – yours! What matters is what happened to multiples and they have kept rising since the fall of 2015:

![]() Data from Pitchbook. Through Q2 2017

Data from Pitchbook. Through Q2 2017

Did Everyone Get it Wrong?

Multiples kept going up because market forces stayed strong:

- Interest rates generally went down from the Autumn of 2015 and are now only slightly higher.

- Credit is still readily available to finance transactions

- Stocks continued their upward march; S&P 500 Index up 22% over the past two years

- The M&A cycle is two years older – still due for a correction?

- Private equity funds have more money to invest than ever before so even though they sold off some companies, they have raised new money and have to put it to work

Did 2015’s Sellers Leave Money on the Table?

Short answer: Maybe, maybe not. Average deal multiples for the middle market went up, it says nothing about any individual company. Are there a larger percentage of higher multiple technology or healthcare companies in the more recent mix? Were the companies on average larger (larger companies generally get higher multiples)? Were there more add-on acquisitions compared to stand alone companies bought (add-ons get bid up because synergistic cost savings allow buyers to pay more)?

So, Should I Sell Now?

As Investment Bankers, we get asked this question a lot. The real answer is that you should sell when you are ready. Trying to time the market, either the broad M&A market or your own industry’s market cycle, is difficult. Everyone wants to sell at the top but given the time it can take to get a transaction closed (nine to twelve months once an advisor is engaged), how do you know when the top is going to be? There is nothing worse than having results go south during the middle of a transaction. Potential buyers either pull out or retrade the deal.

Leave Some Money on the Table for the Buyer

Why would I do that? First, unless you are lucky, you will not sell at the top and things will keep getting better for both your company, your industry and the overall M&A market. That means you will probably leave some money on the table whether you want to or not. Second, buyers need growth and steady earnings to support debt and obtain their returns so they don’t want to buy at the top or on the downslope. Buyers need two to three years of readily visible growth in their deals. Third, you likely will be an equity holder and be playing a role in the company going forward. You don’t want to have to deal with an underperforming, leveraged company.

Keep the Focus Where It Belongs

While you may want the best deal, consider the reasons you are selling your company:

- Diversify the risk of having most of personal wealth in one place

- Get off personal guarantees

- Let someone else run the show and have the pressure and headaches

- Enjoy life more: travel, family, etc.

- Estate planning

- ____________________________

If you sold in 2015, you might have left money on the table, but you would be two years into experiencing the reason(s) you sold, without the risk of changes to your health, your business, your industry, the economy, or the M&A transaction market. After all, this is all hindsight – it could have turned out much differently. Forget about timing the top and consider your personal goals and needs. The right time to sell your business is when you are ready.

For more information please contact Robert Rough, Managing Director, at 214-473-4714 or [email protected]

© Telos Capital Advisors, 2017